According to Lending Tree, 28.7% of Americans struggle to maintain a good credit score. This creates a huge demand for providing services that can help individuals regain financial stability. If you have ever wondered, how to start a credit repair business, this is the perfect time.

The industry is growing with millions of individuals who want some guidance that can help them improve their credit scores. According to Helcim, almost 35% of people aged between 25-54 use their credit cards for transactions.

This is insane and the use is so common because credit will follow you wherever you go. It is one of the most basic things that determines whether you are worthy of that car, business, or house. If you have a bad credit score, then you can say goodbye to those dreams.

This industry is worth millions of dollars as many people struggle to maintain a good credit score. You can help people improve their financial health by improving their credit scores. In this article, we’ll walk you through how to start a credit repair business. You will get detailed guidance from understanding the legal requirements to marketing your services.

Before you start any business, you should have a basic knowledge related to running a business. Here is a detailed guide on how to start a business.

Table of Contents

How to Start a Credit Repair Business

1. Understand the Credit Repair Industry

Before starting any business, it is essential to gain an understanding of that industry. In the same way, you should thoroughly research the credit repair industry before investing your time or money in this venture. When you will be familiar with the basics, you’ll be able to build a successful credit repair business.

What Does a Credit Repair Business Do?

A credit repair business helps its clients by

- Identifying and resolving errors on their credit reports.

- Talk with creditors and negotiate on behalf of clients to improve terms.

- Give personal guidance on boosting and maintaining a healthy credit score.

Research the Market:

Here you should thoroughly research the market. Examine the demand for credit repair services online and locally. You need to identify who your target market is. You need to decide you want to provide your services to whom.

Is it individuals, small businesses, or some specific groups like first-time home buyers? After this, you should completely study your competitors to identify any gaps in their services that you can fill.

Learn Credit Laws:

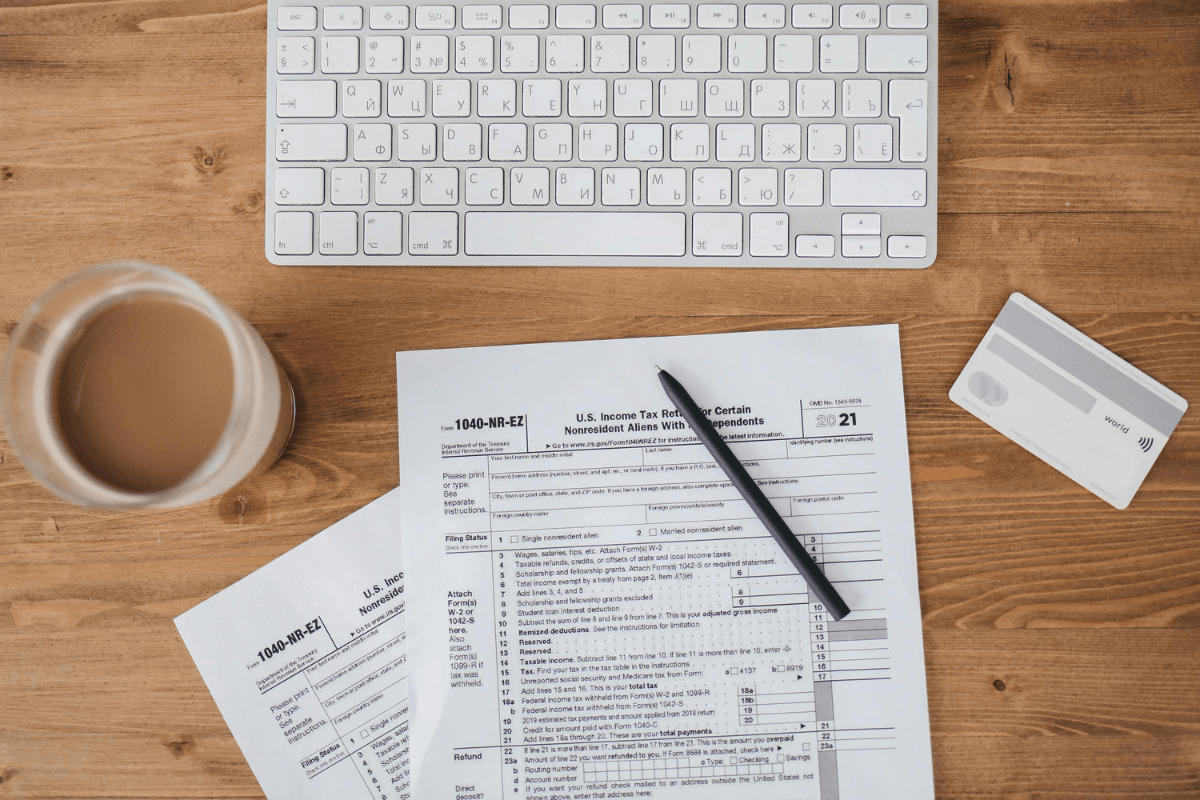

There are some credit laws that you should be completely aware of. These laws are essential to operate ethically and avoid any legal battles. Some of the important laws include:

1. The Fair Credit Reporting Act (FCRA) is a law that oversees how credit agencies can collect and share information about consumers.

2. The Credit Repair Organizations Act (CROA) highlights the rules that credit repair businesses have to follow such as providing written contracts, avoiding upfront fees, and offering cancellation options to their customers.

When you are exploring how to start a credit repair business, you should be well aware of the laws and regulations to operate ethically and legally.

2. Create a Business Plan

A business plan is the backbone of any new venture. It is like a roadmap that guides a person regarding how to operate the business, etc. When you are learning how to start a credit repair business, you should think about creating a business plan.

Five main things should be included in your business plan and these are as follows:

Define Your Services:

After deciding your target audience while you are researching the market, you should now move on and decide the exact services that your credit business will offer.

We needed a target audience to narrow down and decide our niche as it will help us stand out in the competitive industry.

Following are some of the common services:

- Credit report analysis to check errors/inaccuracies

- Dispute handling with credit bureaus on behalf of clients

- Credit-building advice

By defining your services, you’ll have a clear understanding of marketing your business.

Decide Your Revenue Model:

Here, you will decide how you will charge for your services. There are some great options that you can choose from as follows:

- Charge a per-service fee

- Monthly Subscription (recurring monthly fee despite the number of times the clients use the services)

- Bundled packages (a mix of services)

Decide Your Marketing Strategy:

Marketing strategies are an essential part of a business plan. There are many strategies that you can choose from but the most common ones are social media marketing, local advertising (flyers, bulletin boards, newspapers), and partnerships with local realtors, mortgage brokers, and financial advisors.

A detailed business plan will set the base for a successful business easing your burden when you are thinking about how to start a credit repair business.

3. Register Your Business And Get Licenses

Choose a Business Name:

When you plan to start any business, just decide on a unique name that goes well with your business’s industry. A business name helps build trust with the clients.

The business name should be easy to remember. You can name your business something like, “Score Boost Solutions” or “Clear Credit Advisors”. These are just examples, choose something that goes well with your services.

Choose a Business Structure:

Now, here you need to decide about the business structure for your credit repair business. You can choose from the following options:

- Sole Proprietorship is a business owned by a single person. There is no separation between the owner and business and it offers no liability protection.

- An LLC (Limited Liability Company) offers limited liability protection for your assets. It is easy to manage and is separate from you.

- A corporation is best for larger businesses. It is a more formal structure and separate from you. It offers greater protection but it has higher costs to set up.

Get the Licenses, Permits and Register for Tax:

The licenses and permits you need will depend on your location. Some states may mandate a surety bond for credit repair businesses. You should comply with all legal regulations to ensure that your business is on the right track.

After that, you need to apply for an EIN (Employer Identification Number) through the IRS. This is necessary for tax purposes. You will need this number for the following reasons:

- To open a business bank account.

- File Taxes.

- To hire employees in the future.

All of these steps are necessary and must be done if you are thinking about how to start your credit repair business.

4. Invest in Credit Repair Tools and Software

For starting any business, you need some tools and resources to automate different operational processes so that you can focus on growing your business and ensure that everything runs smoothly.

There are various credit repair software that you can use in your business. For example, you could automate the process of sending dispute letters. The specific software will easily generate and send professionally formatted letters to credit bureaus and creditors. You can also easily track your client’s progress using different tools and keep their records.

Following are some popular credit repair tools:

By investing in these tools, you will not only improve efficiency but also enhance the client experience which is a crucial factor when learning how to start a credit repair business successfully.

5. Ensure Compliance with Credit Repair Laws

There is no question about following the laws. These are non-negotiable and you must follow them at all costs. By following these laws, you will be able to protect your business from fines and lawsuits which is essential to build trust with your clients.

You should provide written contracts as mandated by the Credit Repair Organizations Act (CROA). Your letter must contain the service that you will offer, the associated fees, and the expected timeline for results.

Under federal law, it is prohibited for any business to charge upfront fees before completing any service. You should bill your clients after the completion of a task.

According to the Credit Repair Organization Act, you should also provide certain cancellation rights to clients.

When you are thinking about how to start a credit repair business, you should be clear that there is no leverage and you may have to suffer severe penalties in case of not adhering to the laws.

6. Build Your Brand

We are living in a digital age and you can’t run a successful business if you have not built a brand. A professional brand will allow you to get clients for your credit repair business.

At the start, you should create a website. The domain of your website should be just like your business name, it should not be different. Write a detailed description of the services you offer and how they can help improve credit scores.

Share success stories and start a blog where you publish articles like “How to start a credit repair business” or “Common credit report errors” to build authority within the industry. Your website should have a professional logo that will represent your business.

Then create your social media profiles on Instagram, Facebook, and LinkedIn. You can join local community groups, and share content like credit repair tips and client testimonials. And network with lenders and realtors on LinkedIn who can refer clients like you.

By building a professional brand, you will be ensuring that your clients see you as a reliable and professional option for their credit repair needs.

7. Market Your Credit Repair Business

Now this is where the real game begins. Marketing is the backbone of any business. You should use the following online and offline marketing strategies to promote your business and get clients.

Use SEO:

Start by optimizing your website for keywords like, “how to improve credit score” or “credit repair services”. Try to create valuable content that answers relevant credit repair questions and helps your site rank higher in the search results.

Partner with Realtors and Lenders:

This is seriously a goldmine opportunity. Lenders and realtors meet with various clients per day who have bad credit scores. You should network and partner with them to refer their clients to you who need credit repair services. You can offer referral commissions to make this option attractive for them.

Run Online Ads:

You can use platforms like Google Ads and Instagram Ads to target people searching for credit repair solutions. Do highlight your success rates, share real reviews, and give amazing offers to get clients.

Offer Free Consultation:

This is another great way to get clients. You can provide a free initial consultation. This will help build trust with clients and make it easy to assess their needs and how you will be able to help them.

By effectively marketing your business and building a brand, you will be able to create a winning formula for success when you are figuring out how to start a credit repair business.

8. Manage Client Relationships

Clients are the backbone of any service-based business. Happy clients will not only come back to you again but also refer your services in their circle which will eventually help your business grow.

You need to communicate with the clients about the progress of their credit repair process. This can be done via emails, phone calls, or client portals. Educate clients about the need to maintain a good credit score.

You can use some strategies to retain your clients by offering ongoing credit monitoring to prevent any issues in the future. You can also introduce your clients to different financial education programs. A good relationship with your customers will set a strong foundation and this has to be the most important step when exploring how to start a credit repair business.

9. Scale Your Business

By this step, you will have a client base and your operations will be running smoothly. Here you should focus on expanding your business.

As your work increases, you should hire and train employees and focus on providing training that covers all acts such as FCRA, CROA, and everything related to the surety bond.

You can also bring the following types of professionals to handle different aspects of business:

- A credit dispute expert to handle client cases efficiently.

- A customer service representative to ensure clear communication with clients.

- Marketing Specialist to attract more clients and expand your reach.

You should also focus on expanding your services. For this, you can introduce financial counseling to guide your clients on budgeting and money management. Additionally, you could introduce debt management plans to help your clients repay their debts.

Wherever possible you should automate the process. All of these steps are essential when exploring how to start a credit repair business.

Frequently Asked Questions

Is credit repair a profitable business?

Yes, credit repair can be a highly profitable business if you manage to get a steady client base and offer valuable services. Many people need help with improving their credit score so this makes it a high-demand business.

Can you fix bad business credit?

Yes, you can improve bad business credit by disputing errors, negotiating with creditors, and implementing strategies. This can help in building a positive credit history over time.

Can you have bad credit and start a business?

Yes, you can start a business with a bad credit score. You just need to consistently improve your credit score while exploring funding options like personal savings, grants, or working with lenders that accept alternative qualifications.

Can companies remove bad credit?

Credit repair companies can help you by disputing inaccuracies on credit reports and negotiating with creditors. However, accurate negative information cannot be legally removed before its expiration period.

What does a credit repair business do?

A credit repair business helps its clients by identifying and disputing errors on their credit reports, negotiating with creditors, and providing advice on improving their credit scores. Their goal is to assist their clients in achieving better financial standing.

Can I run a credit repair business from home?

Yes, you can run a credit repair business from your home. By using the right tools, software, and communication systems, you can easily manage clients remotely and reduce your overhead costs.

Can I start a credit repair business with no experience?

Yes, but you’ll need to educate yourself on credit laws, repair techniques, and tools before starting this business. You can take courses or use credit repair software to streamline your operations.

Conclusion

Starting a credit repair business is a rewarding journey but requires you to be prepared and have the knowledge and understanding required to offer your services. When learning how to start a credit repair business, you must have thorough industry knowledge.

You have to comply with legal regulations and follow every step mentioned here to ensure that the foundation of your business is strong. By starting this business, you will be able to help clients regain control over their finances and create a pretty good income stream that can potentially build generational wealth.